1

/

of

1

PA- Pennsylvania Debt Securities for Nonprofits Form-203p

PA- Pennsylvania Debt Securities for Nonprofits Form-203p

Regular price

$0.00 USD

Regular price

Sale price

$0.00 USD

Unit price

/

per

Couldn't load pickup availability

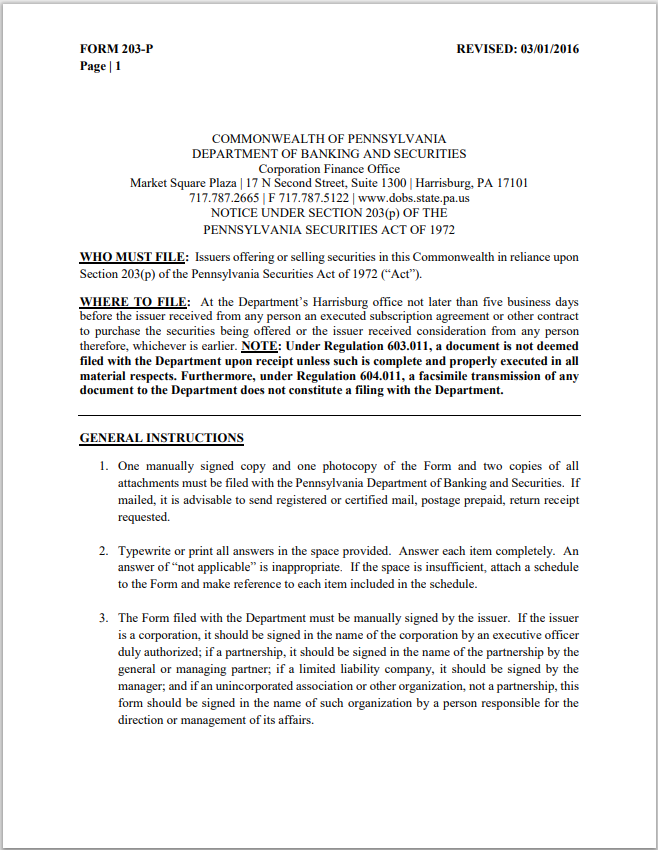

The PA Debt Securities for Nonprofits Form-203p should be completed and filed by issuers relying on the notice under Section 203(p) of the Pennsylvania Securities Act of 1972. Form-203p should be filed with the Pennsylvania Department of Banking and Securities not later than five business days before the issuer received an executed subscription agreement or other contract to purchase the securities being offered or the issuer received consideration from any person, whichever is earlier.

Version/Update: V.U/03/2016

Total Page Count/Format: 6/.pdf

Source/Author(s): Pennsylvania Department of Banking and Securities

Published by: Connexien

View full details