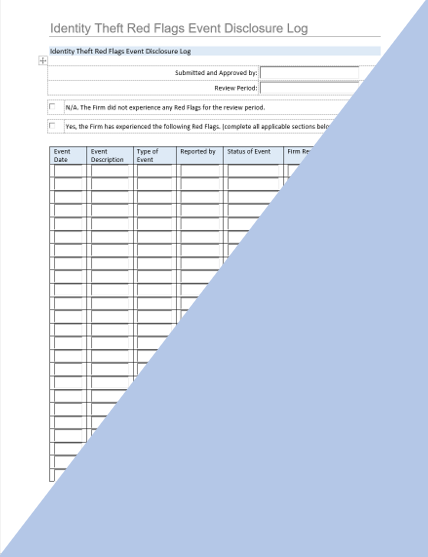

IA- Identity Theft Red Flags Event Disclosure Log

IA- Identity Theft Red Flags Event Disclosure Log

Couldn't load pickup availability

The Investment Adviser Identity Theft Red Flags Event Disclosure Log serves as an important part of an investment adviser’s program to detect, prevent and mitigate identity theft in accordance with Regulation S-ID. The Fair and Accurate Credit Transactions Act of 2003 (FACT Act) Red Flags Rule requires financial institutions—which includes securities firms—implement a program to detect, prevent and mitigate identity theft in connection with the opening or maintenance of covered accounts which include consumer accounts that permit multiple payments or transactions, such as a retail brokerage accounts or any other accounts with a reasonably foreseeable risk to customers or your firm from identity theft. The Dodd-Frank Act transferred responsibility of identity theft red flag rules to the SEC and CFTC for the firms they regulate under Regulation S-ID.

Version/Update: V.2/November 7, 2018

Total Page Count: 1

Source/Author(s): Connexien

Published by: Connexien

View full details